Introduction to Investment Apps

Over the past decade, technology has revolutionized the way people invest, making it more accessible than ever before. Investment apps have become an essential tool for those who want to manage their money efficiently and take control of their financial future. These apps are designed to simplify the investing process, eliminating the need for traditional brokers or complicated platforms. By offering a streamlined experience, they allow users to open accounts, track investments, and execute trades directly from their smartphones.

One of the key drivers behind the popularity of investment apps is the ability to start investing with minimal upfront capital. Many of these platforms cater specifically to beginners by offering low account minimums or options to invest fractional shares. This lowers the barrier to entry, encouraging more people to get started, even if they don’t have large sums of money to invest.

Additionally, the integration of cutting-edge technology has made investing more efficient. Features like real-time updates, automated investing tools, and personalized portfolio recommendations empower users to make informed decisions based on their individual financial situations. By providing tools that simplify complex tasks, these apps have opened the door for individuals who may have previously felt intimidated by the world of investing.

Investment apps also often focus on creating an engaging and approachable experience for users. Many platforms incorporate sleek designs and interactive elements, making the process feel less overwhelming. This focus on accessibility and user engagement has transformed the perception of investing, making it a more approachable activity for a broader audience.

Another advantage of these apps is their accessibility to financial markets that were once harder to reach for everyday individuals. Many apps offer access to a range of investment options, from traditional stocks to exchange-traded funds and alternative assets like cryptocurrencies. This variety ensures users can explore diverse opportunities while tailoring their strategies to fit their financial goals.

By embracing these apps, more individuals are discovering that investing doesn’t have to be complicated or exclusive, allowing them to take the first steps toward building their financial futures.

Features to Look for in an Investment App

When selecting an investment app, it’s important to prioritize features that can simplify and enhance your overall experience. Start by assessing the app’s design and functionality; an intuitive layout can make navigating the platform straightforward, especially for those just beginning. Ease of use is critical, as a well-organized interface helps you focus on your investments without unnecessary distractions.

Another key aspect to evaluate is the app’s ability to support your specific investing needs. Some platforms focus on long-term investing, while others may cater more toward active trading or automated portfolio management. Consider whether the app offers features such as recurring investments or goal-setting tools, which can help you stay consistent and work towards your financial objectives.

Access to market data and analysis is also essential. The best apps provide up-to-date information, such as price changes, performance charts, and relevant news, so you can stay informed when making decisions. Some apps also offer personalized recommendations based on your preferences, which can be helpful in identifying opportunities that align with your goals.

Security features should be another priority. Look for apps that employ encryption and two-factor authentication to safeguard your account and financial information. Transparency regarding fees is equally crucial. Review the app’s pricing structure to ensure you’re fully aware of any charges, such as transaction fees or subscription costs, which could affect your returns over time.

Lastly, consider whether the app provides access to a range of investment options, such as stocks, ETFs, and alternative assets. A broader selection can give you the flexibility to diversify your portfolio and explore different strategies as your experience grows.

Top Investment Apps for Beginners

Several investment apps have gained popularity among beginners in the US due to their user-friendly features and focus on accessibility. Robinhood is a widely recognized platform that offers commission-free trades and a simple interface, making it an excellent choice for those new to investing. Its straightforward design allows users to buy and sell stocks, ETFs, and cryptocurrencies with ease, appealing to individuals looking for a no-frills experience.

Acorns provides a unique approach to investing by utilizing a system that rounds up your everyday purchases and invests the spare change into a diversified portfolio. This micro-investing feature makes it particularly attractive to beginners who may want to start small and gradually grow their investments without needing significant upfront capital. Additionally, Acorns offers automated portfolio management, which can be helpful for those who prefer a hands-off approach.

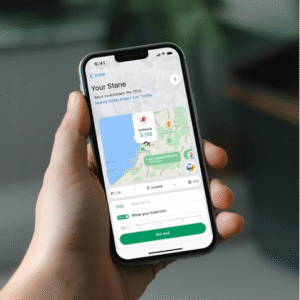

Another platform that stands out is Stash, which combines investing with educational resources to help users make informed financial decisions. Stash allows you to invest in fractional shares, giving you the ability to own portions of expensive stocks without needing a large amount of money. Its tailored educational content and goal-setting tools are especially valuable for those looking to build a foundation of financial knowledge while they invest.

Wealthfront is another app worth considering, particularly for beginners interested in automated investing. It provides robo-advisory services, creating a custom portfolio based on your risk tolerance and financial goals. Wealthfront also includes features such as tax-loss harvesting and financial planning tools, which can help users maximize their returns while managing their long-term objectives.

For those who want a mix of automation and flexibility, Betterment is a strong option. This platform specializes in personalized portfolios and offers tools to help users focus on saving for specific goals, such as retirement. Betterment’s clear fee structure and intuitive design make it an attractive choice for those who value transparency and simplicity.

When evaluating these apps, consider factors like fees, account minimums, and the types of investment options offered. Each platform has unique strengths, so it’s important to choose the one that best aligns with your financial preferences and goals.

Benefits of Using Investment Apps

Investment apps have made managing finances more accessible and straightforward for individuals at every level of experience. One of their standout advantages is the ability to monitor your investments in real-time. With instant updates on portfolio performance and market trends, these apps ensure you’re always informed, helping you make timely decisions without relying on external resources. Many apps also integrate features like personalized notifications, alerting you to significant market movements or updates tailored to your investments.

Another benefit is the incorporation of tools that simplify what might otherwise seem complex. Automated investing options, for instance, are particularly valuable for individuals who prefer a hands-off approach. These features allow the app to handle portfolio adjustments, ensuring alignment with your financial goals without requiring constant input. Similarly, goal-setting functions help users stay on track with specific objectives, such as saving for a major expense or building a retirement fund.

Education is another area where investment apps excel. Many platforms are designed with built-in learning resources that are especially useful for beginners who want to expand their knowledge while actively participating in the market. From basic tutorials to more advanced financial insights, these resources empower users to make smarter decisions over time. Apps with robust educational content can be particularly beneficial for those eager to understand investing concepts without seeking outside guidance.

Cost efficiency is also a key advantage of using investment apps. Traditional investing methods often come with high fees or account minimums that can deter new investors. However, many apps are structured to minimize costs by offering low or no fees for trades and providing access to fractional shares. This makes it possible to start investing without needing to commit large sums of money upfront.

Finally, the availability of diversified investment options enhances the user experience. Many apps allow users to explore a wide range of assets, from stocks and ETFs to alternative investments like cryptocurrencies. This variety enables users to customize their portfolios to match their financial strategy and risk tolerance, all from a single platform. Features like these make investment apps a practical choice for managing finances efficiently.

Potential Challenges for New Investors

New investors often face several challenges when stepping into the world of investing, many of which stem from a lack of experience and knowledge about market dynamics. One of the most significant difficulties is managing expectations. Many beginners expect quick and substantial returns, which can lead to frustration when investments take longer to grow or experience temporary declines. Understanding that investing is a long-term process can help mitigate unrealistic expectations.

Another common challenge is determining how to allocate funds effectively. Without a clear understanding of diversification, beginners may unintentionally put too much money into a single asset or sector, increasing their exposure to risk. Learning to spread investments across various asset classes can reduce the impact of any single underperforming investment on an overall portfolio.

Keeping emotions in check is another hurdle for new investors. Market fluctuations can lead to feelings of panic during downturns or overconfidence during bull markets. Acting impulsively based on emotions rather than strategy can lead to poor decisions, such as selling investments during a dip or buying assets at inflated prices. Developing a disciplined approach and sticking to a well-thought-out plan are critical steps in overcoming this challenge.

The sheer volume of information available can also be overwhelming. With so many resources, news articles, and opinions, beginners may find it difficult to distinguish between reliable advice and noise. This can lead to decision fatigue, where individuals struggle to take action due to excessive options or conflicting advice. Prioritizing reputable sources and focusing on fundamental investing principles can help simplify the process.

Additionally, understanding the fees associated with investing is crucial, as hidden or unexpected costs can erode returns over time. Beginners who are not aware of transaction fees, subscription charges, or other expenses may find that these costs eat into their gains. Taking the time to research and choose cost-effective options can help prevent this issue.

Lastly, staying consistent with investing habits can be a challenge, especially when balancing other financial obligations. It’s important for beginners to establish a routine, whether it’s contributing small amounts regularly or reviewing their portfolio periodically. Creating a sustainable habit early on can lay the groundwork for long-term success in the market.

Conclusion: Making Your First Investment

Starting your investment journey can feel like a big step, but breaking it down into manageable actions makes the process far less intimidating. Focus on identifying what you hope to achieve, whether it’s saving for retirement, building wealth, or preparing for a significant future expense. Once your goals are clear, think about the timeline for reaching them, as this can help determine the level of risk you’re willing to take.

Take advantage of the tools and features offered by your chosen investment app to stay organized and track your progress. Many apps provide resources to help beginners learn the basics of investing, so use these to build confidence in your decisions. If your app includes automated options, consider setting up recurring investments. This can help you develop a consistent habit of putting money toward your goals without needing to think about it frequently.

When starting out, it’s a good idea to diversify your investments to reduce risk. Allocating funds across different asset types, such as stocks, ETFs, or bonds, can help protect your portfolio from being overly impacted by the performance of a single investment. Fractional shares, available on many apps, are particularly helpful for beginners who want to spread their funds across multiple assets without requiring significant capital.

It’s also essential to approach investing with a long-term perspective. Markets naturally experience ups and downs, so staying focused on your goals instead of reacting to short-term changes can make a big difference. Avoid making impulsive decisions based on market fluctuations, and instead, stick to your plan while periodically reviewing your portfolio to ensure it aligns with your objectives.

Finally, don’t hesitate to ask questions or seek advice when needed. Many platforms have customer support or community forums where you can learn from others’ experiences. As you become more familiar with the process, continue to educate yourself about different investment strategies and opportunities. Over time, these habits will not only improve your skills as an investor but also increase your confidence in managing your financial future.