Introduction to Student Credit Cards

Managing personal finances during college can feel overwhelming, especially when juggling tuition, rent, and day-to-day expenses. Student credit cards offer a helpful solution, providing a flexible way to handle costs while offering opportunities to establish a credit history early on. Designed specifically for young adults, these cards often come with lower credit limits and beginner-friendly terms, making them an excellent starting point for financial learning.

With many options available, it’s important to understand what sets student credit cards apart from traditional ones. Many include features tailored to student needs, such as no annual fees or rewards on common spending categories like groceries and public transportation. Additionally, some issuers offer educational tools or resources to help new cardholders better understand responsible credit use.

By selecting the right card and using it wisely, students can gain valuable experience in managing credit, which can set the stage for greater financial independence

Benefits of Student Credit Cards

Student credit cards are designed with features that make them a practical option for young adults managing their finances for the first time. Many cards offer rewards or cashback on purchases in everyday spending categories, such as groceries, transportation, or dining out, which can provide added value to students working within a limited budget. These benefits can make it easier to offset regular expenses while encouraging mindful spending.

Another advantage is the added convenience and security that credit cards provide. They are widely accepted for online transactions, making it simple to pay for subscriptions, order textbooks, or shop for essentials without relying on cash or debit cards. Credit cards also offer fraud protection, giving students peace of mind knowing they are safeguarded against unauthorized charges.

Some student credit cards include access to financial management tools and educational resources. These tools can help cardholders track their spending, set budgeting goals, and better understand how credit works. By using these resources, students can develop good financial habits and gain a clearer picture of how to manage their money effectively.

Additionally, many student credit cards offer perks such as discounts at retailers or promotional deals with partner companies. These offers can make a meaningful difference, particularly for students looking to save on purchases they already plan to make. For those studying abroad or traveling, some cards even waive foreign transaction fees, making them a cost-effective option for international use.

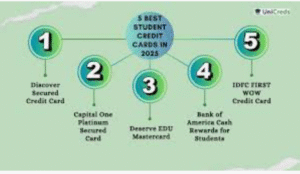

Top Credit Cards for Students in the UK 2025

When exploring the top student credit cards in the UK for 2025, it’s essential to focus on key features like interest rates, rewards, and fee structures. Among the standout options is the Santander 123 Student Credit Card, which offers cashback on regular spending categories like groceries and transportation, helping students make the most of their daily purchases. This card also provides a manageable credit limit, which can be particularly helpful for first-time users who are still learning to budget effectively.

The HSBC Student Credit Card is another strong contender, boasting no annual fees and access to exclusive discounts at popular retailers. This card is ideal for students looking to save money on frequent purchases while enjoying the convenience of credit. Its straightforward terms make it an accessible choice for those new to credit cards, ensuring that cardholders can use it confidently without hidden costs or surprise.

For students who prioritize rewards, the NatWest Student Credit Card delivers value with its loyalty program. This card offers points for consistent use, which can be redeemed for various perks or discounts. Additionally, it provides tools to track spending, making it easier for users to stay within their budget while earning rewards.

When choosing between these options, consider how the card’s benefits align with your personal spending patterns. Some cards are better suited for everyday expenses, while others shine in their ability to offer rewards or discounts in specific categories.

How to Choose the Right Student Credit Card

When deciding on a student credit card, it’s essential to weigh factors like interest rates, fees, and benefits. Start by reviewing the Annual Percentage Rate (APR) offered, as a lower APR means reduced interest costs if you ever carry a balance. However, it’s always best to aim for paying off your balance in full each month to avoid interest altogether.

Next, consider the credit limit. Many student credit cards come with modest limits, which can be a helpful way to encourage responsible spending and budgeting. Evaluate whether the offered limit aligns with your typical expenses without tempting you to overspend.

Fees are another critical aspect to examine. While many student credit cards waive annual fees, some may include charges for late payments, balance transfers, or cash advances. Understanding these potential costs ensures you won’t be caught off guard.

Rewards and perks should also factor into your decision. Some cards provide cashback or points for purchases in specific categories, like dining, groceries, or public transportation. If you frequently spend in a particular area, choosing a card that offers rewards for those transactions can help you save money or earn additional benefits.

Additionally, some credit card issuers provide access to free financial tools, like budgeting apps or spending trackers. These features can be especially helpful for students who are new to managing their finances. By choosing a card with these tools, you can gain better control over your spending habits and work toward building a solid credit history.

Another consideration is the acceptance of the card. While most cards are widely used, it’s important to ensure your chosen card is accepted in the places you shop or, if applicable, during international travel. Some cards even waive foreign transaction fees, making them particularly useful for students studying abroad.

Lastly, take time to review the terms and conditions. Understanding the fine print ensures you’re aware of interest rate changes, payment requirements, and any restrictions tied to rewards or promotional offers. This step can help you avoid misunderstandings and make a well-informed decision.

Managing Credit Responsibly as a Student

Having a credit card as a student is a significant responsibility, and the way you manage it can have lasting effects on your financial future. A key step is to set clear spending limits for yourself and treat your credit card like cash—only use it for purchases you can afford to pay off in full by the due date. This approach ensures you avoid unnecessary interest charges while staying within your budget.

It’s equally important to track your spending regularly. Many credit card issuers provide apps or online tools that make it easy to monitor transactions and set alerts for upcoming payment deadlines. These features can help you stay on top of your account activity and avoid overspending. Establishing a habit of checking your account frequently not only keeps you informed but also helps identify any unauthorized transactions early.

Making at least the minimum payment on time each month is non-negotiable. Late payments can lead to penalty fees and negatively impact your credit score, making it harder to access loans or other financial products in the future. Setting up automatic payments through your bank or card issuer can ensure you never miss a due date. However, whenever possible, aim to pay your balance in full to avoid carrying debt into the next billing cycle.

Another important aspect of responsible credit use is understanding how much of your credit limit you’re utilizing. Financial experts generally recommend keeping your credit utilization below 30% of your available limit. For example, if your credit limit is $1,000, try not to carry a balance exceeding $300 at any given time. Keeping utilization low demonstrates to lenders that you are managing your credit well.

If you’re unsure about the terms of your credit card, such as how interest is calculated or when payments are due, take the time to review the details provided by your card issuer. Being informed can prevent costly mistakes and help you use your card more effectively.

Lastly, avoid using your credit card for non-essential purchases or to fund lifestyle expenses beyond your means. Building good habits early on will position you for greater financial stability as you transition out of college and into the workforce.

Frequently Asked Questions about Student Credit Cards

Student credit cards often come with questions about how they function and what benefits they offer. A common concern is whether applying for a credit card will harm your credit score. While a hard inquiry may cause a small, temporary dip in your score, responsible use—such as paying your balance on time and keeping your credit utilization low—can improve your credit over time.

Another frequently asked question is about eligibility. Most student credit cards require applicants to be enrolled in higher education and may ask for proof of enrollment, such as a student ID or acceptance letter. Some issuers also require a minimum income or a co-signer if you lack a credit history.

Many students wonder how rewards programs work. Depending on the card, you may earn points, cashback, or discounts on specific purchases. For example, some cards provide higher rewards rates for spending on groceries, transportation, or dining, which are common expense categories for students. Be sure to review the card’s rewards structure to ensure it matches your spending habits.

Another question involves interest rates. While student credit cards may have lower limits and introductory perks, their interest rates can still be high if you carry a balance. It’s essential to understand the Annual Percentage Rate (APR) and how interest accrues if you’re unable to pay your balance in full each month.

Additionally, students often ask about fees associated with these cards. While many student credit cards waive annual fees, there may be other charges, such as late payment fees or foreign transaction fees. Carefully reading the card’s terms and conditions will help you avoid unexpected costs.

Finally, some students are curious about building credit while studying abroad. Many student credit cards work internationally, but it’s important to check whether your card waives foreign transaction fees and is widely accepted at your destination. These factors can make a difference when using a credit card outside the United States.

By addressing these common questions, students can feel more confident about navigating their credit card options and making informed decisions.

Conclusion: Making the Most of a Student Credit Card

Using a student credit card effectively requires thoughtful planning and a focus on long-term goals. Start by identifying how the card’s benefits align with your spending habits and financial needs. Whether it’s cashback on daily purchases or access to tools that help track expenses, understanding the card’s features allows you to make the most of its advantages.

Responsible usage is key to building good credit. Treat your credit card as a tool for necessary expenses rather than an extension of your budget. By staying within your credit limit and paying off your balance on time, you’ll not only avoid costly interest charges but also demonstrate reliability to future lenders. Keeping your credit utilization low can further enhance your credit profile, paving the way for better financial opportunities down the line.

It’s also important to stay informed about your card’s terms. Regularly reviewing statements and understanding how fees or interest rates may apply can prevent unwanted surprises. Many credit cards now offer online access and mobile apps, making it easier than ever to monitor transactions and set payment reminders. Taking advantage of these features ensures you remain organized and proactive about your finances.

Additionally, keep in mind that your student credit card can be a stepping stone toward financial independence. Learning to manage credit early provides a strong foundation for handling more advanced financial products in the future. As you gain experience, you can transition to credit cards with higher limits or additional rewards, equipped with the skills to use them wisely.

Finally, remember that a credit card should complement, not replace, other financial strategies. Establishing a budget, maintaining an emergency fund, and limiting non-essential spending are equally important for long-term success. By combining these habits with responsible credit use, you’ll be well-positioned to achieve your financial goals and enjoy greater stability after graduation.see more